How LP Mandates Rewired Southeast Asia's Venture Market

For anyone building in SEA over the next 24 months: incorporate in Singapore and engineer unit economics for 12-month payback, or accept that institutional venture capital is structurally unavailable.

Southeast Asia's venture funding fell approximately 75-80% from $25-27 billion in 2021 to roughly $5-7 billion in 2025. The compression was structural. Seed check sizes actually increased slightly—median seed rounds moved from approximately $2.6 million in 2021 to $3.5 million by 2024-2025 —but the traction required to clear that check increased substantially. A seed round that assumed $50K-100K ARR in 2021 now demands $500K-1M ARR and proof of unit economics.

LP mandates drove this shift contractually. When zero-interest-rate policy ended in 2022-23, LP focus shifted from IRR maximization to DPI (distributions to paid-in capital) preservation. Sixty percent of LPs now prioritize DPI over TVPI in fund evaluations. The math reset everything downstream.

The Three-Stage Cascade

Stage 1: LP Return Repricing

With limited liquidity from exits, LPs cannot recycle capital back into new venture funds. Portfolio companies that cannot demonstrate a path to distributions within fund lifecycles became unfundable. The timeline constraint became binding.

Stage 2: Investor Requirement Shift

Series A investors responded mechanically. Portfolio companies needing profitability visibility to meet LP hurdles meant Series A companies required metrics proving this path: 120%+ net revenue retention can command 25-50% higher valuations, while burn multiple and clear unit economics became table stakes.

When Series A ARR thresholds rose from approximately $1M to $1.5-3M ARR, the gap propagated backward. Seed investors watched graduation rates collapse from 51-61% to 36% for 2021 cohorts and just 20% for 2022 cohorts, and responded by demanding seed companies hit what Series A companies previously needed.

Stage 3: Founder Constraint

Seed-to-Series A timelines extended significantly—at comparable timeframes, only ~5% of 2022 seed companies had raised a Series A within ~20 months versus ~23% of 2020 seed companies. Founders faced a mechanical squeeze: hit aggressive milestones and risk burning cash before Series A, or cut burn and stagnate below investor thresholds. Most chose a third option: bootstrap, take non-institutional capital, or fold.

The 2021 seed cohort's 36% graduation rate versus 51-61% historical reflects these threshold mechanics—and the 2022 cohort is tracking even worse at approximately 20%.

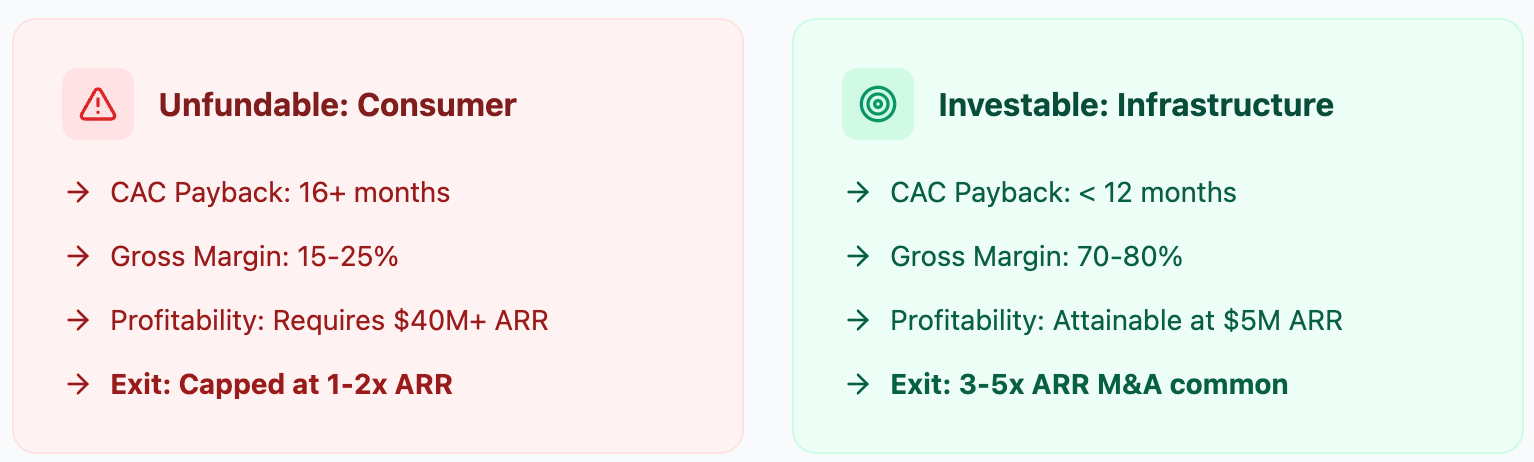

Where Unit Economics Break

The sectoral shift follows clear logic. Enterprise infrastructure with 70-80% gross margins and multi-year contracts hits acceptable payback periods at lower ARR thresholds. Consumer marketplaces with high CAC and lower take rates require significantly higher scale to achieve the same economics.

The bifurcation is mechanical: B2B SaaS companies can demonstrate Series A-ready metrics at $1-2M ARR, while consumer businesses require substantially higher revenue bases to prove sustainable unit economics.

Singapore's 90% Capture

SEA funding has pooled. Singapore absorbed 63.7% of SEA funding in 2023 and 84-92% in 2025. LP mandates restrict deployment to OECD-recognized jurisdictions or countries with clear legal recourse.

Startups incorporated in Indonesia or Vietnam lock out 60-70% of institutional capital due to remittance risk and opaque governance structures. Singapore offers compelling structural advantages: 100% foreign ownership permitted, 0% capital gains tax, 0% withholding tax on dividends, and startup tax exemptions reducing effective rates to 0% on the first S$100,000 of income for new entities.

Indonesia's funding collapsed to less than $80 million in H1 2025 compared to approximately $200 million in H1 2024. The eFishery scandal exposed systematic fraud: the company reported $752 million in revenue when actual revenue was $157 million—a nearly 5x inflation—and claimed $16 million profit against an actual $35.4 million loss. The fraud dated back to 2018, with management maintaining dual financial reports and inflating fish feeder counts from 24,000 to 400,000 units.

Founders optimizing for institutional access incorporate in Singapore regardless of operational footprint. Grab, Sea, and Lazada generate <30% of revenue in Singapore but domicile there for exit liquidity. A Jakarta logistics startup hiring locally but incorporating in Singapore captures institutional capital while maintaining cost arbitrage.

| Metric | Singapore | Indonesia | Delta |

|---|---|---|---|

| VC funds domiciled | 150+ | <20 | 7.5× |

| Median Series A | $12M | $4M | 3× |

| Exit liquidity (2023–25) | $8B+ | <$500M | 16× |

| FX approval time (>$1M) | Instant | 3–6 months | ~180× slower |

Geographic concentration is mandatory for institutional access.

Second-Order Effects

Seed funding in SEA fell to $214 million in 2025, down 57% from $497 million in 2024 and 73% from $804 million in 2023. Deal volume reached approximately 335 equity rounds in 2025.

Three consequences follow:

Talent availability. Operators laid off from 2021 cohorts take roles at 40-60% of 2021 compensation. Performance marketing costs fell 30-40% as customer acquisition demand declined. Founders hiring in 2025 face structurally lower talent and CAC costs.

M&A as primary exit. SEA has produced zero venture-backed IPOs since GoTo (2022) and Grab (2021)—both down 60-80% from listing prices. Median M&A valuation: 3-5x ARR for profitable companies, 1-2x ARR for unprofitable. Banks consolidate fintech (Kasikorn acquired Satang for $100M), hyperscalers buy infrastructure (NinjaOne acquired Dropsuite for $270M). This caps investor returns to 3-5x versus 10-20x IRR expectations, accelerating the feedback loop.

Founder retention breaks. Founders retaining 60-70% equity at Series A (versus 40-50% in 2021) face 3+ years of 60-80 hour weeks without large teams. Equity packages in illiquid, slower-growth companies reduce retention leverage. Median SEA exit is now $50-150M via M&A.

Structural Forces

Three forces suggest permanence:

LP distribution focus is structural. With 60% of LPs now prioritizing DPI over TVPI, and limited exit activity generating distributions, capital recycling into new funds remains constrained.

Exit multiples are determined by acquirer economics. When strategic acquirers pay for market position rather than technology and prefer consolidated vendors, valuations stabilize at lower multiples.

Infrastructure economics create durable differentials. Contractual lock-in with 70-80% gross margins versus consumer volatility with higher churn produces a permanent gap in fundability thresholds.

Observable Behavior

Companies that bootstrapped to $500K ARR before raising had 3x higher Series A graduation rates (62% vs. 21%) in 2024-25 cohorts. Companies with structural distribution—government contracts, enterprise partnerships, platform integrations—raised seed at 40% lower ARR thresholds. Alternative capital (revenue-based financing, angels) filled 23% of seed volume in 2024 versus 8% in 2021.

Consumer fintech founders raised at $500K ARR in 2025 versus $0-100K in 2021—a 10x threshold increase. Neobanks and BNPL companies now appear in acquisition conversations.

The Constraint That Matters

The threshold change varies by model and distribution channel, but the floor moved. Graduation rates fell from 51-61% historically to 36% for 2021 cohorts and 20% for 2022 cohorts. ARR requirements rose significantly across stages.

Southeast Asia's venture market now operates under structural capital scarcity. Founders building consumer businesses without structural distribution or strong unit economics cannot access institutional capital—regardless of execution quality. The capital stack sorted itself into infrastructure (fundable) and consumer (challenging by institutional standards).