Southeast Asia's Series A Squeeze: Restructuring Regional Venture DNA

Southeast Asia’s venture landscape is undergoing capital Darwinism. The so-called “Series A squeeze” is rewriting the rules of survival: only startups with discipline on unit economics and clear profitability paths are breaking through.

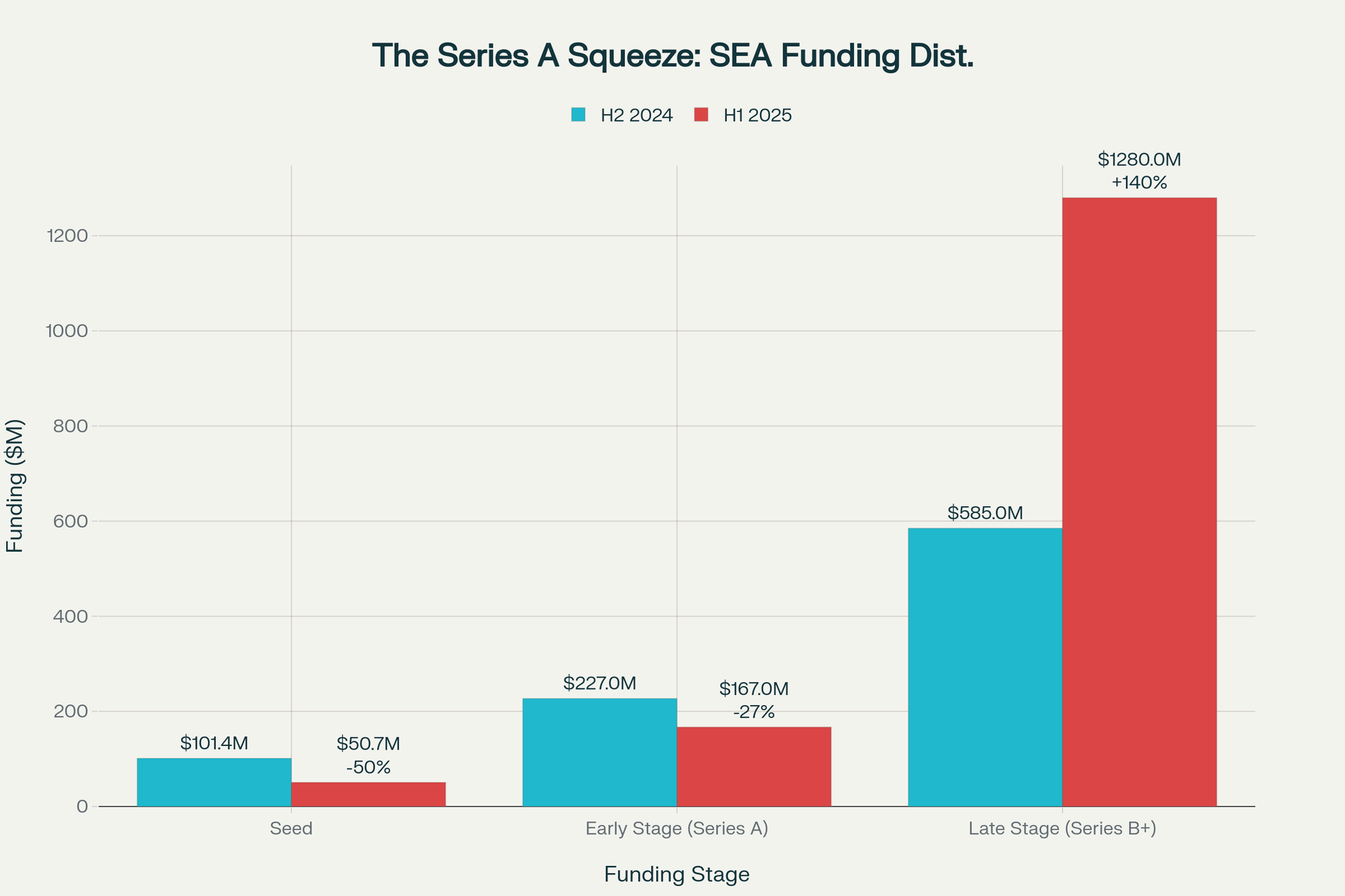

The numbers strip away any pretense of a soft landing. In H1 2025, Southeast Asia's seed funding collapsed 50% to just $50.7 million while Series A deals plummeted 27% to $167 million. Yet late-stage funding—reserved for companies that already survived the gauntlet—surged 140% to $1.28 billion. This isn't market correction; it's capital Darwinism. The Series A squeeze is reshaping who gets to play the venture game, and most aren't making the cut.

Southeast Asia's funding shifted dramatically toward late-stage deals in H1 2025, with seed funding collapsing 50% while late-stage rounds surged 140%

The bottleneck exposes Southeast Asia's structural flaw: a region addicted to growth-at-all-costs finally meeting its reckoning with unit economics. For over a decade, founders burned through capital under the Silicon Valley delusion that 660 million consumers would subsidize indefinite losses through sheer scale. That fantasy died in 2024 when platforms began "focusing on ROI, margin discipline, and operational leverage" instead of costly subsidy wars. The Series A squeeze is capitalism's autopsy report.

A Regional Funding Anomaly

Amid regional drought, the Philippines presents a defiant anomaly. H1 2025 marked the first time Philippine startups ($86.4 million) outpaced Indonesia ($78.5 million), as Indonesia suffered a catastrophic 67% funding decline. This Philippine surge—16.6% growth to $1.12 billion in 2024 funding—occurred despite four consecutive years of decline in global startup rankings.

Philippines startups raised $86.4M in H1 2025, surpassing Indonesia ($78.5M) for the first time as the archipelago nation saw a 67% funding decline

The explanation isn't Philippine exceptionalism but strategic timing and regulatory opportunism. While Indonesia's oversaturated e-commerce and ride-hailing sectors face margin compression, Philippine startups target structural gaps with immediate revenue potential: fintech infrastructure, rural connectivity, diaspora remittances. More critically, Philippine founders learned pandemic lessons about sustainable foundations over unicorn valuations. Packworks pivoted during COVID-19 lockdowns to prioritize unit economics over user acquisition—an approach now attracting capital in an environment demanding 12-18 month profitability paths rather than five-year moonshots.

The Structural Breakdown: Three Failures Feeding the Squeeze

The Series A drought stems from fundamental misalignment between startup metrics and investor reality. Three structural failures create this bottleneck:

Runway Erosion: The 18-month runway standard collapsed. Investors now demand 24-36 months of cash reserves, but Southeast Asian startups burn through seed funding in 14-18 months while failing to demonstrate sustainable unit economics. With CAC payback periods stretching beyond 18 months and LTV:CAC ratios below 3:1, companies approach Series A conversations with balance sheets screaming "toxic asset."

Exit Pathway Sclerosis: Southeast Asia managed only 28 exits in 9M 2024, down 26% year-over-year, with zero IPOs. Exit value was propped up entirely by secondary sales like PropertyGuru's $1.1 billion EQT acquisition. When late-stage companies can't exit, they can't return capital to LPs, throttling new fund formation and creating downward pressure throughout the funding chain.

Cultural Resistance to Cash Flow Reality: The growth-at-all-costs mentality remains embedded despite economic reality. As one regional VC noted: "Startups were incentivized to chase growth at all costs, which often burned through millions to acquire users who were never going to convert". This 2020-2021 boom hangover continues plaguing investor diligence, where founders present GMV growth while hemorrhaging cash on customer acquisition that never converts to sustainable revenue.

Policy Interventions and Alternative Capital: The System's Immune Response

Regional governments attempt intervention through policy innovation, though with mixed strategic clarity:

Singapore expanded Startup SG Equity with S$440 million additional funding, increasing per-company caps from S$8 million to S$12 million for deep tech. This bets patient capital for longer development cycles can bypass Series A by funding companies directly to Series B+.

Malaysia's Digital Status offers 10-year tax exemptions and 100% investment tax allowances, effectively subsidizing startup operational costs to extend runway and improve Series A attractiveness.

More significantly, alternative capital sources are filling the Series A void. Family offices now represent 33% of regional investors, up from 20% in 2020. HSBC launched a $150 million venture debt program, while revenue-based financing allows Southeast Asian fintechs to choose "strategic debt financing rather than equity dilution". This trend reflects founder recognition that traditional venture pathways have become structurally dysfunctional.

The Post-VC Reality: Three Evolutionary Paths

Southeast Asia accelerates toward what we term the post-VC reality—where traditional venture capital becomes one option among many rather than the primary growth engine. Three scenarios emerge:

The Discipline Dividend: The squeeze produces operators with deeper unit economics discipline and regional strategies. Companies like Mekari, which scaled with minimal outside funding for years before meaningful funding rounds, become the template. This path yields smaller but sustainable 2-10x returns over unicorn fantasies.

The Fragmentation Trap: Capital gaps force premature consolidation, with promising companies selling to regional conglomerates at depressed valuations, reducing ecosystem dynamism and innovation velocity.

The Alternative Capital Renaissance: Family offices, venture debt, and government co-investment create parallel funding infrastructure bypassing traditional VC entirely, producing more resilient companies with fundamentally different growth trajectories and exit expectations.

The Evolutionary Filter

The Series A squeeze represents evolutionary pressure distilling Southeast Asia's venture ecosystem to its essence. The region's venture DNA is being rewritten by companies embracing three principles: revenue-first models achieving positive unit economics within 12 months, regional market fragmentation as competitive moat rather than obstacle, and alternative capital structures optimizing for cash flow generation over VC returns.

The startups surviving this squeeze will emerge as antifragile organizations built for sustainable growth where capital is scarce and exits limited. They form the foundation of Southeast Asia's next venture cycle—one built on pragmatism over hype, cash flow over GMV, regional differentiation over global homogenization.

The question isn't whether the squeeze will end—it's whether the ecosystem emerging will have learned the right lessons. In a region of 660 million consumers, the companies winning are those solving real problems with sustainable economics, not burning capital chasing Silicon Valley dreams. The Series A squeeze is venture capital's teacher, and class is in session.