Capital Darwinism Favors the Efficient and the PH was Built for It

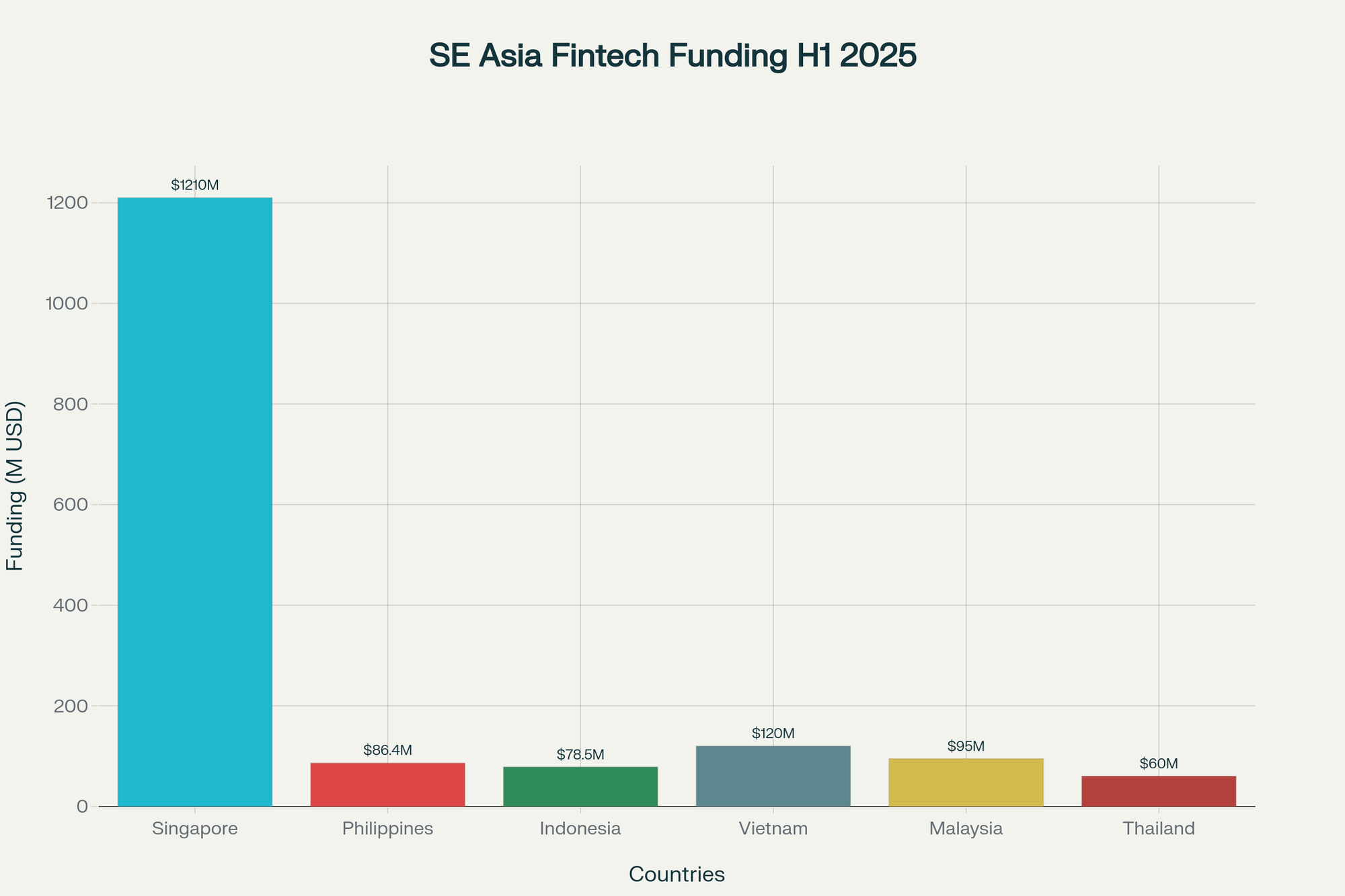

Southeast Asia’s Series A squeeze stripped away the illusion of easy money. Singapore may command 88% of fintech capital, but Philippine operators thrive on discipline. The irony? The market that couldn’t attract capital may be the only one that learned to live without it.

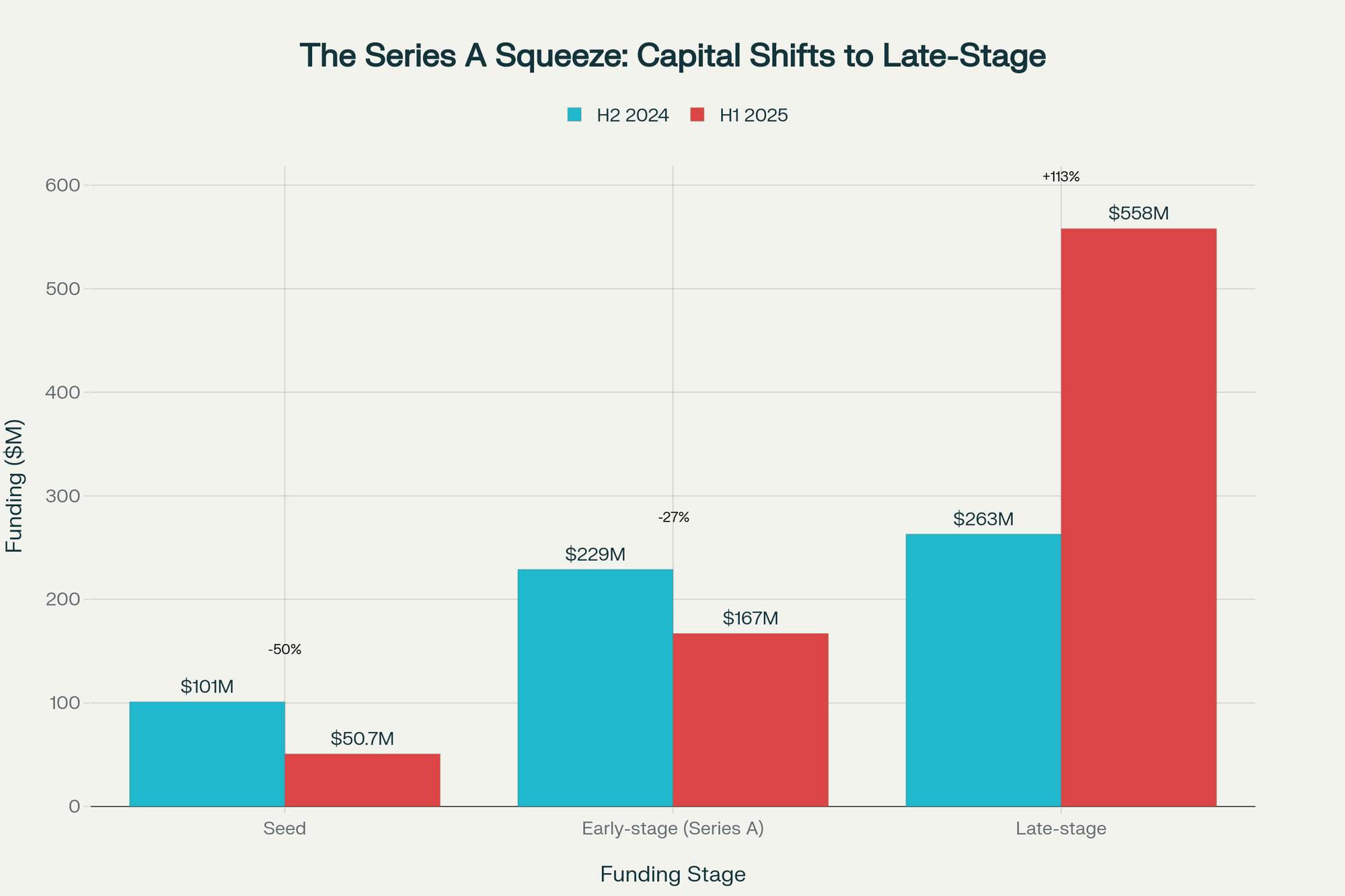

In a market that learned to live without abundant capital, efficiency isn't a constraint—it's a moat. Southeast Asia's venture landscape has undergone what can only be described as financial natural selection, where seed funding collapsed 50% in H1 2025 while late-stage rounds surged 113%. The message from capital markets is unambiguous: grow efficiently or perish. And in this Darwinian moment, the Philippines emerges as an unexpected survivor—a market where necessity has bred exactly the kind of capital-efficient operators that the current environment rewards.

While Singapore commands 88% of regional fintech funding with deals averaging $150M+, Philippine operators achieve superior unit economics on a fraction of the capital. This isn't an accident of geography but the result of structural constraints that forced discipline from day one. As venture debt provider Martin Tang observed at Emergence 2025, "The ecosystem has gone through a lot of ups and downs" over the past decade. What he didn't mention is that the companies surviving those cycles—particularly in the Philippines—developed exactly the operational DNA that today's funding environment demands.

The Anatomy of Capital Darwinism

Southeast Asia's funding winter arrived with mathematical precision. H1 2025 marked the region's weakest funding performance in six years, with total startup capital plummeting to $1.85 billion. But the distribution reveals the real story: early-stage funding collapsed 65% year-over-year while late-stage concentrated into fewer, larger bets. Capital Darwinism is selecting for Philippine fintechs that ship cash-flow utility, not vanity GMV.

The Series A squeeze exposes a fundamental flaw in the regional venture model: a decade-long addiction to subsidizing growth with investor capital, betting that sheer scale would validate negative unit economics. That fantasy died when platforms began "focusing on ROI, margin discipline, and operational leverage". The bottleneck isn't just filtering weak companies—it's rewriting the genetic code of venture capital itself.

Three structural failures feed this evolutionary pressure. First, runway erosion: the 18-month standard has collapsed, with investors demanding 24-36 months of reserves while Southeast Asian startups burn through seed funding in 14-18 months. Second, exit pathway sclerosis: the region managed only 28 exits in 9M 2024, down 26%, with zero IPOs. Third, cultural resistance to cash flow reality: founders still present GMV growth while hemorrhaging cash on acquisition that never converts to sustainable revenue.

Constraint as Competitive Advantage

Against this carnage, the Philippines presents a statistical anomaly that challenges conventional venture wisdom. H1 2025 marked the first time Philippine startups ($86.4 million) outpaced Indonesia ($78.5 million), as the former regional champion suffered a 67% funding decline.

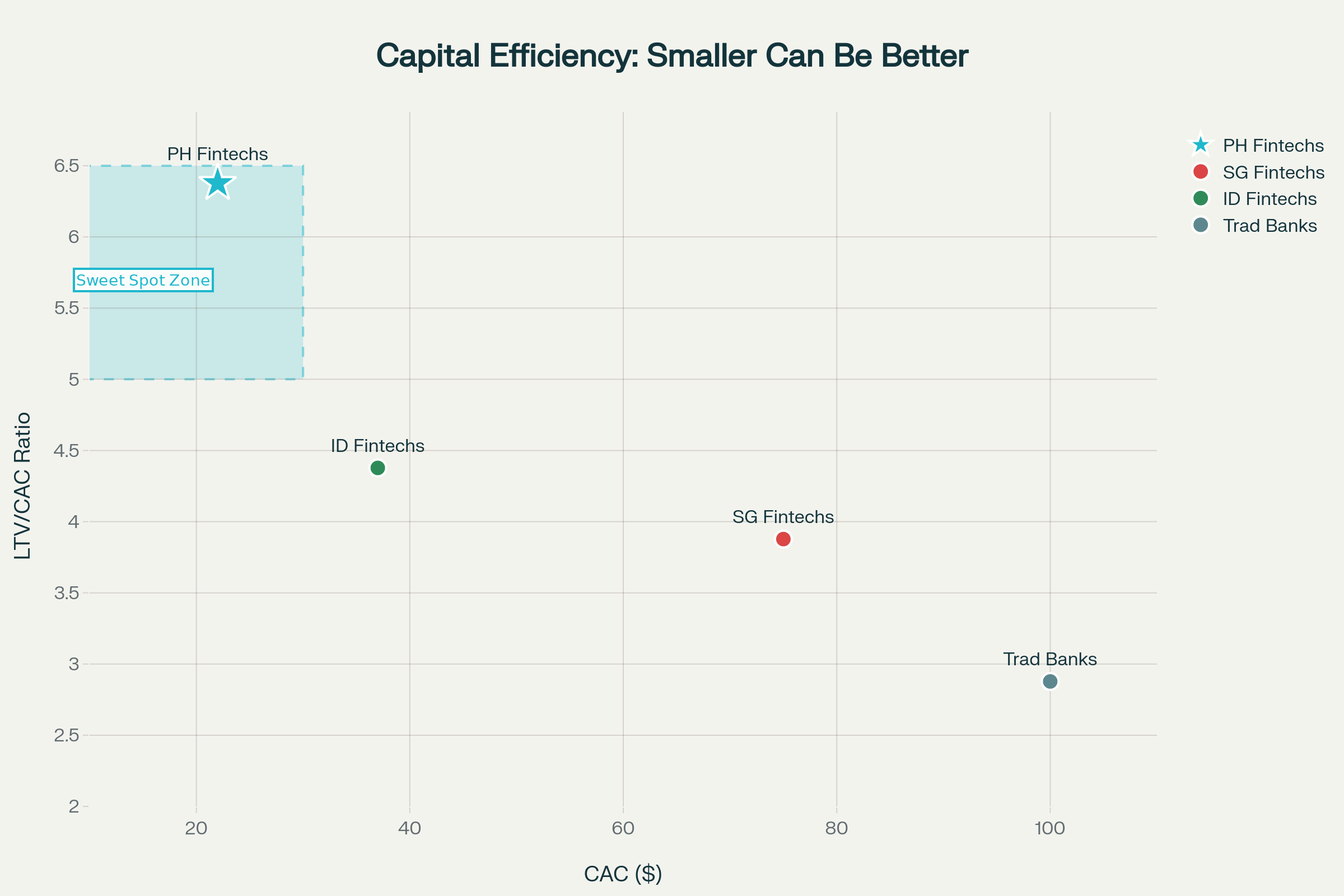

The numbers reveal a fundamental reimagining of venture economics. While Singapore fintechs chase 15-25x revenue multiples with $50-100 customer acquisition costs, Philippine operators achieve 8-12x multiples with $15-30 CAC. More critically, Philippine fintechs reach profitability in 18-24 months versus Singapore's 36-48 months. The BSP's latest data confirms only two of six digital banks are profitable, but expects all to break even within the 5-7 year timeline—faster than global averages where only 5% of digital banks achieve profitability.

Case Studies in Disciplined Evolution

PayMongo: Infrastructure as Cash-Flow Utility

PayMongo illustrates the Philippine approach to scaling through constraint. Rather than chasing vanity GMV, the company expanded from a payments gateway into a modular "Financial OS," adding programmable ledgers, wallet disbursements, and merchant financing in 30 months. Recent disclosures point to 4.3x growth in total payment volume and 3x revenue growth while maintaining positive gross margins.

The company's API-led model enables SMEs and platforms to embed financial services without building infrastructure in-house—a capital-efficient way to capture recurring revenue streams. CEO Jojo Malolos projects breakeven in Q1 2026, aligning with the broader trend that only efficiency-driven operators are rewarded in the current environment. PayMongo's SOC2 certification and regulatory partnerships signal enterprise readiness achieved without the typical capital intensity of infrastructure plays.

Salmon: Alternative Capital Structures

Salmon Group demonstrates how non-dilutive capital is reshaping Philippine fintech. Its $138M raise—split between equity and Nordic bonds—marks the region's first such structured issuance and signals global debt appetite for Philippine credit models. The oversubscription of its bond tranches shows how investors are selectively backing lenders with sustainable margins rather than growth-at-all-costs plays.

Operating both a BSP-regulated bank and SEC-licensed financing company, Salmon combines 8.88% deposit rates with disciplined lending practices. The company's AI-driven underwriting across 3,000+ partner stores bridges digital infrastructure with physical distribution—critical for market penetration without massive marketing spend. This hybrid model generates revenue from both sides of the balance sheet while maintaining risk-adjusted returns that rival traditional lenders.

Tonik: Profitability as Strategy

Tonik Digital Bank underscores the viability of the profitability-first thesis in digital banking. Its lending-first model generates 83% of revenue from credit products, delivering a 16x LTV/CAC ratio and 25% risk-adjusted returns that rival top-tier local incumbents. The $65 million loan portfolio demonstrates scale achieved through operational discipline rather than subsidized growth.

Tonik expects to reach profitability by Q4 2025—just four years after launch and significantly faster than the global digital banking average where only 5% achieve sustainable margins. While the sector's elevated NPL ratios reflect higher-risk customer segments, Tonik's AI-powered underwriting and efficient operations keep the business model within striking range of sustainable scale. The bank's trajectory validates that capital-constrained environments can produce world-class unit economics.

Proof of Exit is Needed

The Philippine fintech thesis faces its ultimate test: can efficiency translate into investor returns? Operational resilience is clear, but until liquidity events occur, efficiency remains hypothesis, not proof.

IPO Pipeline: Thin but Symbolic

The IPO pipeline is limited. Analysts expect only two significant listings in 2025—Maynilad and potentially Globe Fintech Innovations (Mynt), GCash’s parent.

Mynt’s case gained credibility after Mitsubishi UFJ Financial Group acquired an 8% stake in February 2025, valuing the company at $5 billion. The deal signals strategic validation, but without an actual listing, IPO readiness remains an open question.

Alternative Capital: M&A and Venture Debt

M&A activity is building. PwC Philippines projects financial services will lead consolidation in 2025, with scale and efficiency deciding who consolidates and who gets acquired.

Meanwhile, venture debt is emerging as a viable path. The launch of Genesis Alternative Ventures’ $125M Southeast Asia fund points to appetite for non-dilutive capital—providing efficient fintechs the runway to reach profitability without equity dilution.

The Validation Gap

Despite strong fundamentals, the Philippines has yet to produce a landmark exit. IPOs remain scarce, M&A is nascent, and venture debt is still experimental. The next 18 months—Tonik’s profitability, potential Mynt IPO, and M&A velocity—will show whether capital efficiency can deliver real investor returns.

Capital Darwinism's Ultimate Selection

Southeast Asia's Series A squeeze represents evolutionary pressure distilling the venture ecosystem to its essence. The companies surviving aren't the best funded but the best adapted. In this environment, the Philippines' historical disadvantages—limited capital access, smaller rounds, longer funding cycles—become selective advantages.

The numbers support this contrarian view. While Singapore celebrates its 88% funding dominance, Philippine fintechs quietly achieve twice the capital efficiency at one-third the cost. While Indonesian unicorns burn through emergency funding rounds, Philippine operators approach profitability with sub-$100M total raises.

This isn't about choosing poverty over prosperity. It's about recognizing that venture capital's obsession with scale before sustainability has reached its natural conclusion. The Series A squeeze isn't a temporary correction but a permanent restructuring of how value gets created in emerging markets. In this new reality, the companies that survive won't be those that raised the most, but those that needed the least.

The Philippine fintech ecosystem isn't perfect. Exit opportunities remain limited, infrastructure gaps persist, and global investors still view Manila as Singapore's poor cousin. But these challenges pale compared to the fundamental question facing regional venture capital: would you rather own 10% of a company burning $1M monthly with no path to profitability, or 20% of one generating positive unit economics on $300K monthly?

The irony is delicious: the market that couldn't attract capital may be the only one that learned to live without it. In the end, that may be the greatest competitive advantage of all.